Samsung Pay Mini iOS rejected? Yeah, that’s a bummer. The dream of a streamlined Samsung payment experience on iPhones just hit a major roadblock. This isn’t just about a rejected app; it’s a clash of tech titans, a battle for your digital wallet, and a fascinating peek behind the curtain of Apple’s notoriously strict App Store approval process. We’re diving deep into the reasons why Samsung’s mini-version might have been sent back to the drawing board, exploring the potential conflicts with Apple Pay, and uncovering the strategies Samsung could use to finally get their app on the App Store.

This situation highlights the complexities of navigating the app ecosystem, especially when dealing with established players like Apple. We’ll analyze the technical hurdles, design considerations, and legal compliance issues that likely contributed to the rejection, offering insights into the challenges of creating a successful mobile payment app in a competitive market. Get ready for a tech deep-dive!

Comparison with Competitor Mobile Payment Apps

Samsung Pay Mini’s journey to the iOS App Store has been, shall we say, *interesting*. The rejection, while seemingly addressed, highlights the inherent challenges of navigating the walled garden that is Apple’s ecosystem. A key element of this challenge lies in how Samsung Pay Mini stacks up against its established competitors, Apple Pay and Google Pay. Understanding these differences is crucial to grasping the complexities of app store approval and the potential conflicts that can arise.

The core issue boils down to competition within a tightly controlled environment. Apple, understandably, prioritizes its own services and products. Any app that threatens to disrupt this carefully constructed ecosystem faces a higher hurdle for approval. Let’s delve into a feature comparison to illuminate the potential points of friction.

Feature Comparison of Mobile Payment Apps

The following table compares key features of Samsung Pay Mini, Apple Pay, and Google Pay, highlighting potential areas of conflict with Apple’s policies. The impact on App Store approval is speculative, but based on observed trends and past experiences with similar applications.

| Feature | Samsung Pay Mini | Apple Pay | Google Pay | Potential Impact on App Store Approval |

|---|---|---|---|---|

| Device Compatibility | Limited to Samsung devices (potentially expanding); iOS compatibility is the key issue. | Works with most iPhones and Apple Watches. | Works with a wide range of Android devices. | Restricting functionality to a subset of iOS devices could be seen as limiting the user base, leading to rejection. Broader compatibility is preferred. |

| Payment Network Support | Likely supports major credit and debit cards, potentially NFC and MST. | Supports major credit and debit cards, Apple Cash. | Supports major credit and debit cards, Google Pay Balance. | If Samsung Pay Mini offers features not directly integrated with Apple’s payment system, it could be viewed as competitive and lead to rejection. |

| Integration with Other Apple Services | Minimal or non-existent, at least initially. | Seamless integration with Apple Wallet, iMessage, and other Apple services. | Integrates with various Android services, but not as deeply as Apple Pay. | Lack of integration with Apple services is a significant factor; Apple favors apps that work harmoniously within its ecosystem. |

| Security Features | Likely uses tokenization and biometric authentication (fingerprint/face ID). | Emphasizes strong security measures, utilizing tokenization and biometric authentication. | Similar security features to Apple Pay, utilizing tokenization and biometric authentication. | Meeting Apple’s rigorous security standards is paramount; any perceived weakness could result in rejection. |

Differences in Mobile Payment App Approval Processes

The approval processes for mobile payment apps on iOS and Android differ significantly, reflecting the contrasting philosophies of their respective app stores.

- iOS App Store: A more stringent and centralized review process, prioritizing security, privacy, and integration with the Apple ecosystem. Rejection is common if an app is deemed competitive with Apple’s own services or poses a security risk. Appeals are possible but not guaranteed.

- Google Play Store: A less restrictive process, with a focus on functionality and compliance with Google’s policies. Rejection is less frequent, but still possible for security concerns or policy violations. Appeals are generally more straightforward.

Potential Areas of Direct Competition with Apple’s Ecosystem

Samsung Pay Mini’s potential to compete directly with Apple’s ecosystem lies primarily in its functionality and user experience. Any feature that replicates or surpasses Apple Pay’s core capabilities creates a direct competitive threat.

- Offering a superior user interface or experience: If Samsung Pay Mini provides a more intuitive or user-friendly payment experience, it could attract users away from Apple Pay.

- Providing exclusive features or partnerships: Offering unique features or partnerships not available within Apple Pay could entice users to switch.

- Aggressive marketing and promotion: A strong marketing campaign emphasizing the advantages of Samsung Pay Mini could erode Apple Pay’s market share.

User Experience and Design Considerations: Samsung Pay Mini Ios Rejected

Samsung Pay Mini’s iOS rejection highlights the crucial role of user experience (UX) and design in navigating Apple’s stringent app store guidelines. A seamless, intuitive, and secure experience is paramount for success, especially within the competitive mobile payment landscape. This section details a proposed user interface flow and best practices for a hypothetical Samsung Pay Mini iOS app, focusing on minimizing friction and maximizing user satisfaction.

Creating a successful mobile payment app on iOS requires a deep understanding of Apple’s Human Interface Guidelines (HIG) and a commitment to prioritizing security and user-friendliness. A well-designed app not only adheres to Apple’s standards but also enhances user trust and encourages adoption. The following explores a potential UX/UI flow and design best practices.

Proposed User Interface Flow for Samsung Pay Mini iOS

The following Artikels a streamlined user interface flow, minimizing steps and potential points of friction. This design prioritizes clarity, security, and adherence to Apple’s design language.

Samsung Pay Mini’s iOS rejection stings, especially considering the tech world’s obsession with streamlined security. The news comes hot on the heels of rumors suggesting a Touch ID return for the 12-inch MacBook Air, as reported by this article. It makes you wonder – is Apple playing it close to the chest with biometric tech, or are there deeper reasons behind both decisions?

Ultimately, the Samsung Pay Mini rejection leaves a lot of unanswered questions.

- Onboarding: The initial screen welcomes users, explaining Samsung Pay Mini’s core functionality (quick, secure payments) and requesting permission to access relevant device features (e.g., Apple Wallet, location services for nearby payment options, if applicable). The design emphasizes simplicity and clarity, utilizing Apple’s standard onboarding patterns.

- Card Addition: Users can add cards via manual entry (with clear input fields and error handling) or by scanning their cards using the device’s camera. Clear instructions and visual cues guide the user through the process. A progress indicator shows the status of the card addition.

- Payment Selection: A simple, visually appealing list displays added cards. Each card is clearly identified (card type, last four digits, visually distinct iconography). Users can easily select their preferred payment method.

- Authentication: Utilizing Apple’s recommended authentication methods (Face ID or Touch ID), the app securely verifies the user’s identity before proceeding with the transaction. This is a crucial step for security and compliance.

- Transaction Confirmation: A clear summary screen displays the transaction details (merchant, amount, card used) before final confirmation. Users can easily review and cancel the transaction if needed. The design incorporates visual cues to highlight critical information.

- Transaction History: A dedicated screen displays a chronological list of past transactions. Each entry includes date, time, merchant, amount, and payment method. Users can easily search and filter transactions.

Best Practices for Designing a Secure and User-Friendly Mobile Payment App

Designing a secure and user-friendly mobile payment app requires a multi-faceted approach. The following best practices ensure the app adheres to Apple’s design standards while prioritizing security and ease of use.

- Adhere to Apple’s Human Interface Guidelines (HIG): Consistent use of Apple’s design language, including typography, color palettes, and UI elements, creates a familiar and intuitive experience. This is essential for app store acceptance.

- Prioritize Security: Implement robust security measures, including end-to-end encryption, secure data storage, and multi-factor authentication. Compliance with industry security standards (e.g., PCI DSS) is crucial.

- Intuitive Navigation: The app should be easy to navigate, with clear visual cues and a logical information architecture. Minimize the number of steps required to complete a transaction.

- Clear Error Handling: Provide helpful and informative error messages, guiding users on how to resolve issues. Avoid technical jargon and use plain language.

- Accessibility: Design the app to be accessible to users with disabilities, adhering to Apple’s accessibility guidelines. This includes features like VoiceOver support and sufficient color contrast.

- Regular Updates: Continuously update the app with security patches and new features, ensuring it remains secure and relevant.

Marketing Image Mock-up Description, Samsung pay mini ios rejected

The marketing image would showcase a clean, minimalist design reflecting Apple’s aesthetic. The image would feature a phone displaying the Samsung Pay Mini app’s main screen, highlighting the simplicity of adding a card and the ease of initiating a payment. A subtle graphic element, such as a shield icon, would subtly represent security without being overwhelming. The background would be a soft, neutral color. The tagline could be something like “Samsung Pay Mini: Secure, Simple, Seamless.” The overall impression would be one of trust, ease of use, and modern elegance, reflecting both Samsung and Apple’s brand identities.

Technical Solutions and Mitigation Strategies

Samsung Pay Mini’s iOS rejection necessitates a deep dive into potential technical issues and robust mitigation strategies. Addressing Apple’s specific concerns requires a multifaceted approach, encompassing code improvements, enhanced security, and a meticulous resubmission process. This section Artikels concrete solutions and steps to navigate the App Store review process successfully.

Technical Solutions for App Store Rejection

The following table details potential problems encountered during the Samsung Pay Mini iOS submission, along with proposed solutions, implementation details, and potential risks. Remember, specific rejection reasons will vary depending on Apple’s feedback, so this is a general framework.

| Problem | Solution | Implementation Details | Potential Risks |

|---|---|---|---|

| Insufficient Security Measures (e.g., lack of proper encryption) | Implement end-to-end encryption using a robust cryptographic library like OpenSSL or BoringSSL. | Integrate encryption at all stages of data transmission and storage. Regularly update cryptographic libraries to address vulnerabilities. Conduct thorough security audits. | Increased development time and complexity; potential for introducing new bugs if not implemented carefully. |

| Poor Performance or Crashes | Optimize code for iOS performance. Conduct thorough testing on various iOS devices and versions. | Use profiling tools to identify performance bottlenecks. Implement memory management best practices. Employ automated testing frameworks for regression testing. | Requires significant testing and debugging; potential for delays in release. |

| UI/UX Issues (e.g., non-compliance with Apple’s Human Interface Guidelines) | Revise UI/UX design to fully comply with Apple’s HIG. | Thoroughly review Apple’s HIG documentation. Conduct usability testing with target users. Iterate on design based on feedback. | Potential for significant redesign effort; requires careful consideration of user experience. |

| Insufficient Payment Processing Capabilities | Ensure seamless integration with Apple Pay’s payment infrastructure. | Follow Apple’s guidelines for integrating with Apple Pay. Thoroughly test payment processing functionalities. Implement robust error handling. | Potential for integration challenges; requires understanding of Apple Pay’s APIs. |

| Lack of Compliance with Apple’s App Store Review Guidelines | Carefully review and adhere to all Apple’s App Store Review Guidelines. | Consult Apple’s documentation and relevant resources. Address any potential compliance issues proactively. | Requires thorough understanding of Apple’s policies and guidelines. |

Resubmission Process to the App Store

Addressing Apple’s feedback effectively is crucial for successful resubmission. The process generally involves these steps:

A methodical approach is essential to ensure all feedback points are comprehensively addressed. This includes not only fixing bugs but also providing clear documentation to Apple explaining the changes made.

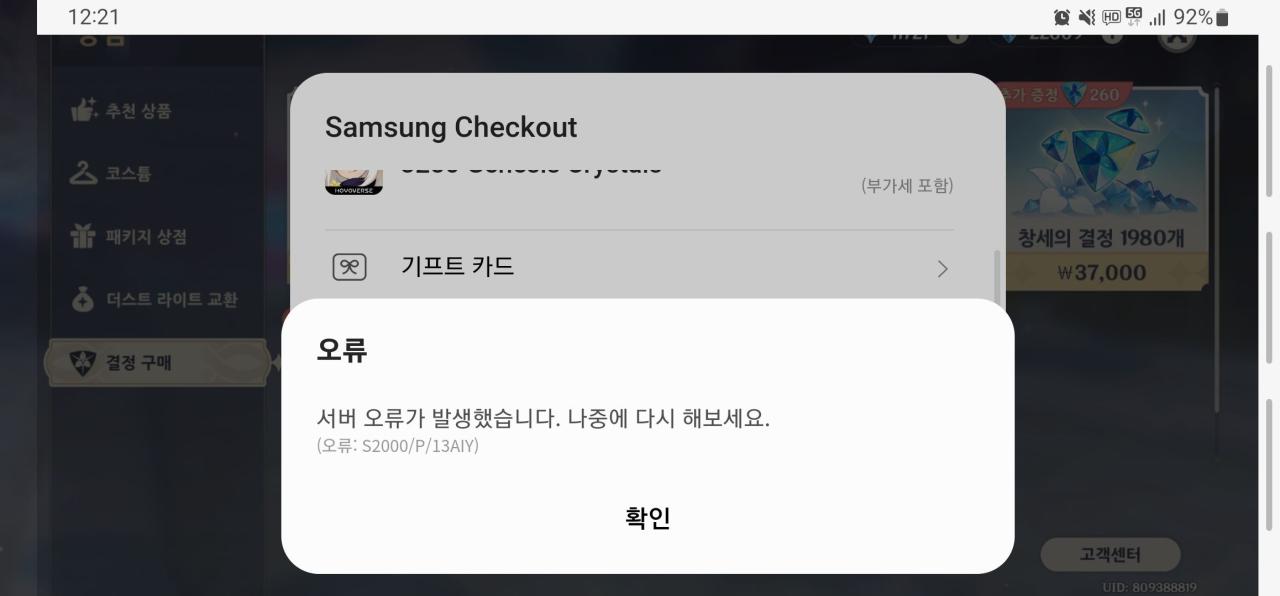

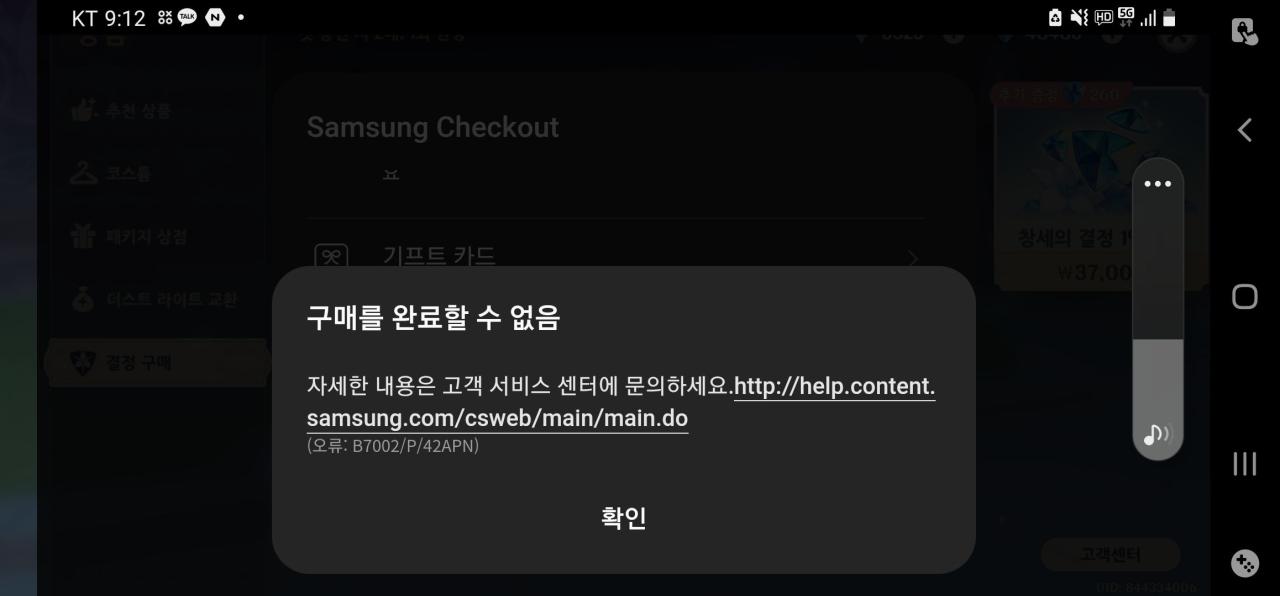

- Carefully review Apple’s rejection email and identify all specific concerns.

- Implement the necessary code changes and design modifications to address each concern.

- Thoroughly test the updated app on various iOS devices and versions.

- Prepare a detailed response to Apple, clearly outlining the changes made and providing evidence (e.g., screenshots, test results) to demonstrate the resolution of each issue.

- Submit the updated app through App Store Connect, including the detailed response to Apple’s feedback.

- Monitor the app’s status in App Store Connect and respond promptly to any further inquiries from Apple.

Implementing Robust Security Measures

Protecting user data is paramount in a mobile payment application. Robust security measures must be implemented at every stage.

This involves a layered security approach, combining various techniques to ensure comprehensive protection against potential threats.

- Data Encryption: Employ end-to-end encryption for all data in transit and at rest. Use strong encryption algorithms and regularly update cryptographic libraries.

- Secure Storage: Use Apple’s secure enclave to store sensitive data like cryptographic keys. Avoid storing sensitive information in plain text.

- Authentication and Authorization: Implement strong authentication mechanisms like biometric authentication (Touch ID, Face ID) and multi-factor authentication.

- Regular Security Audits: Conduct regular security audits and penetration testing to identify and address vulnerabilities.

- Compliance with Security Standards: Adhere to relevant security standards and regulations, such as PCI DSS (Payment Card Industry Data Security Standard).

Legal and Compliance Aspects

Navigating the legal landscape for a mobile payment app, especially one aiming for Apple’s App Store, requires meticulous attention to detail. Failure to comply can lead to app rejection, hefty fines, and reputational damage. This section Artikels key legal and compliance considerations for Samsung Pay Mini on iOS.

The development and launch of any financial technology application, particularly one operating within the restrictive environment of the Apple App Store, necessitates a comprehensive understanding of relevant legal and compliance frameworks. Ignoring these crucial aspects can result in significant setbacks and potential legal repercussions.

Apple’s App Store Review Guidelines

Apple’s App Store Review Guidelines are a comprehensive set of rules governing app submissions. Adherence is mandatory for app approval and continued availability. Non-compliance can result in app rejection or removal. Key areas relevant to Samsung Pay Mini include those concerning financial transactions, data security, and user privacy. Specific guidelines related to payment processing, user data protection, and appropriate disclosures must be strictly followed. Failure to meet these standards will likely result in rejection.

Data Privacy Regulations

Adhering to data privacy regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) is paramount. These regulations dictate how personal data is collected, processed, stored, and protected. For a mobile payment app, this includes user financial information, transaction history, and potentially location data. Failure to comply with these regulations can lead to significant fines and legal action. For example, a failure to provide users with clear and concise information about data collection practices, or a data breach resulting from inadequate security measures, could trigger investigations and penalties under GDPR and CCPA. Implementing robust data encryption, anonymization techniques, and transparent data handling policies are crucial steps towards compliance.

Potential Implications of Non-Compliance

Non-compliance with Apple’s App Store guidelines or data privacy regulations carries several potential implications. App rejection is the most immediate consequence. This can significantly delay launch and incur additional development costs. Beyond rejection, legal action from users or regulatory bodies is a possibility, leading to financial penalties and reputational damage. For example, a data breach exposing user financial information could result in class-action lawsuits and hefty fines from regulatory authorities. Furthermore, negative publicity surrounding non-compliance can severely impact user trust and adoption rates. Maintaining a strong commitment to legal and regulatory compliance is therefore essential for the long-term success of any mobile payment application.

The Samsung Pay Mini iOS rejection saga underscores the intense scrutiny mobile payment apps face, particularly within Apple’s walled garden. While the specific reasons remain (mostly) confidential, the analysis reveals a complex interplay of technical challenges, competitive pressures, and regulatory compliance. Ultimately, the story serves as a cautionary tale and a case study in the challenges of navigating the iOS app ecosystem. Whether Samsung will overcome these hurdles and bring their mini-payment solution to iOS remains to be seen, but one thing’s for sure: the stakes are high in the mobile payment arena.

Insurfin Berita Teknologi Terbaru

Insurfin Berita Teknologi Terbaru