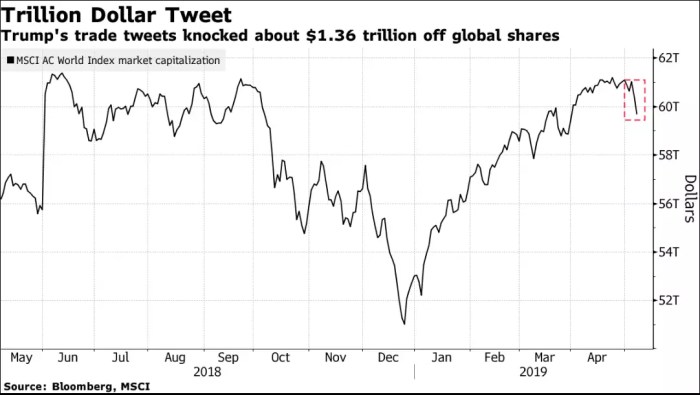

Algorithm to trade on Trump tweets: sounds crazy, right? But in the wild world of high-frequency trading, even a president’s 280-character musings can move markets. This deep dive explores the creation of an algorithm that analyzes Trump’s tweets, gauges market sentiment, and generates trading signals. We’ll dissect the challenges, explore various sentiment analysis techniques, and even touch on the ethical and legal minefields involved. Buckle up, it’s going to be a wild ride.

We’ll cover everything from data acquisition and preprocessing—cleaning up that Twitter mess—to designing a robust algorithm that can identify those crucial market-moving tweets. We’ll delve into risk management strategies essential for this high-stakes game, explore how to integrate technical indicators like RSI and MACD, and visualize the algorithm’s trading signals to make them easily digestible. Finally, we’ll address the ethical and legal considerations of using social media data for profit. Prepare to learn how to potentially leverage the power of presidential tweets (responsibly, of course!).

Developing an Algorithmic Trading Strategy

Building an algorithm to profit from Trump’s tweets requires a sophisticated approach that goes beyond simple searches. We need a system capable of interpreting the nuanced language of his pronouncements and translating them into actionable trading signals, all while mitigating substantial risk. This involves careful consideration of tweet content, sentiment analysis, and robust risk management.

The core challenge lies in designing an algorithm that can accurately predict market movements based on often unpredictable and volatile statements. A successful strategy needs to be fast, accurate, and capable of adapting to the ever-changing landscape of political and economic news.

Identifying Significant Market-Moving Tweets

The algorithm must go beyond simple matching. It needs to analyze the context of the tweet, considering factors like the time of day, the current market conditions, and the historical impact of similar tweets. Natural Language Processing (NLP) techniques, including sentiment analysis and topic modeling, are crucial. The algorithm should also incorporate machine learning models trained on historical data to improve its predictive accuracy over time. For example, a tweet mentioning specific companies or sectors would trigger a higher level of scrutiny and potential trading action compared to a general political statement.

Criteria for Classifying a Market-Moving Tweet

Several criteria determine whether a tweet is deemed “market-moving.” These criteria involve a combination of quantitative and qualitative assessments. Firstly, the algorithm should measure the tweet’s sentiment – is it positive, negative, or neutral? Secondly, it needs to identify the tweet’s target – which specific companies, sectors, or markets are directly or indirectly affected? Thirdly, the algorithm should consider the tweet’s context – what was happening in the market before the tweet was posted? Finally, the algorithm should assess the tweet’s historical impact – have similar tweets in the past caused significant market fluctuations? A tweet scoring highly across these criteria would be flagged as market-moving.

Risk Management Strategies for High-Frequency Trading

High-frequency trading based on Trump’s tweets inherently carries significant risk. Robust risk management is paramount. This involves setting strict stop-loss orders to limit potential losses on any given trade. Diversification of the trading portfolio is also crucial, reducing exposure to any single asset or sector. Furthermore, the algorithm should incorporate a “cool-off” period after a significant market event to avoid over-trading and emotional decision-making. Regular backtesting of the algorithm using historical data is essential to refine its performance and identify potential weaknesses. Finally, a system for monitoring and adjusting the algorithm’s parameters in real-time is crucial for adapting to changing market conditions and unforeseen events.

Examples of Potential Trading Signals

Consider these hypothetical scenarios:

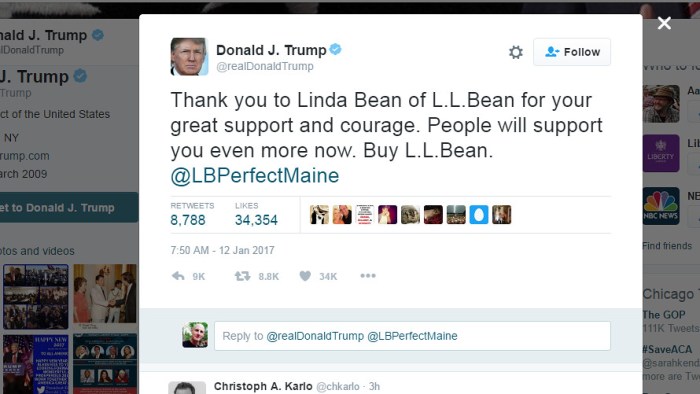

Scenario 1: A tweet expressing strong support for a specific company could trigger a “buy” signal. For example, a tweet praising a particular pharmaceutical company’s COVID-19 vaccine could lead to a surge in its stock price.

Scenario 2: A tweet announcing new tariffs on a specific country’s goods could trigger a “sell” signal for companies heavily reliant on imports from that country. This could cause a drop in their stock price.

Scenario 3: A tweet expressing negative sentiment towards a particular economic policy could trigger a broader market sell-off, prompting the algorithm to take defensive positions.

It’s crucial to remember that these are hypothetical examples. The actual impact of any given tweet is highly dependent on numerous factors and cannot be predicted with certainty. The algorithm’s effectiveness relies on its ability to accurately assess these complex interactions.

Predicting market swings based on Trump’s tweets? That’s some seriously high-stakes algorithmic trading. The precision needed reminds me of the stunning visuals in kojima sample images decima engine , where every detail counts. Building a reliable algorithm for Trump tweets requires similar levels of meticulous attention to detail, sifting through noise for meaningful patterns that can actually predict market movements.

Data Acquisition and Preprocessing: Algorithm To Trade On Trump Tweets

Building a successful algorithmic trading strategy based on Trump’s tweets requires a robust data pipeline. This involves efficiently collecting the relevant tweets, cleaning them to remove noise and irrelevant information, and finally transforming the data into a format suitable for algorithmic analysis. Ignoring this crucial preprocessing stage can lead to inaccurate signals and ultimately, significant financial losses.

This section details the methods employed to acquire and prepare Trump’s tweet data for our algorithmic trading system. We’ll cover data collection, handling noisy data, addressing missing information, and the final transformation of the raw data into a usable format.

Tweet Data Collection, Algorithm to trade on trump tweets

The first step is acquiring the historical tweets. This can be achieved using the Twitter API (subject to Twitter’s terms of service and rate limits). Alternatively, third-party data providers offer pre-compiled datasets of historical tweets, often with enhanced features like sentiment scores. The chosen method depends on factors such as budget, required data volume, and the need for real-time data. A crucial aspect is ensuring compliance with Twitter’s API usage guidelines and any relevant legal regulations. For example, one might use the Tweepy library in Python to interact with the Twitter API, efficiently fetching tweets based on specific s, user IDs, or date ranges.

Handling Noisy Data

Twitter data is inherently noisy. This includes irrelevant tweets, retweets, replies, and the presence of hashtags, mentions, and URLs. Cleaning this data involves several steps. First, we remove irrelevant tweets that don’t pertain to market-relevant topics. This might involve using filtering or analyzing the tweet’s context. Second, we remove retweets and replies to focus solely on original tweets from the target account. Third, we process the text to remove irrelevant characters such as hashtags, mentions (@mentions), and URLs. This is often done using regular expressions. Finally, we handle special characters and emoticons, converting them into standardized forms or removing them entirely. For example, a regular expression like `r”@\w+|http\S+|#\w+”` could be used to remove mentions and URLs.

Dealing with Missing Information

Missing data is a common problem in any dataset, and Twitter data is no exception. Tweets might be deleted, unavailable due to API limitations, or simply lost during the data collection process. Strategies for handling missing data include imputation (replacing missing values with estimated values), deletion (removing rows or columns with missing data), or using algorithms robust to missing data. The choice depends on the extent of missing data and its potential impact on the analysis. For instance, if a significant portion of tweets are missing for a particular period, using a simple mean or median imputation might suffice. More complex methods, like K-Nearest Neighbors imputation, can be used for more sophisticated handling of missing values.

Data Transformation

The raw tweet data needs to be transformed into a format suitable for the trading algorithm. This usually involves text preprocessing techniques like tokenization (splitting the text into individual words), stemming (reducing words to their root form), and lemmatization (converting words to their dictionary form). The processed text can then be converted into numerical representations using techniques like TF-IDF (Term Frequency-Inverse Document Frequency) or word embeddings (Word2Vec, GloVe). These numerical representations capture the semantic meaning of the tweets and can be used as input features for the trading algorithm. Furthermore, sentiment analysis can be performed to assign numerical scores representing the overall sentiment (positive, negative, or neutral) of each tweet. This sentiment score can then be incorporated into the trading signals.

Data Acquisition and Preprocessing Pipeline

Imagine a flowchart. The first box is “Acquire Tweets via Twitter API (or third-party data)”. An arrow leads to “Clean Tweets: Remove Retweets, Replies, Irrelevant Characters”. Another arrow from this box leads to “Handle Missing Data: Imputation or Deletion”. Another arrow points to “Transform Data: Tokenization, Stemming, Lemmatization, TF-IDF/Word Embeddings, Sentiment Analysis”. Finally, an arrow from this box leads to the final box: “Formatted Data for Algorithm”. This flowchart visually represents the sequential steps involved in the entire data preprocessing pipeline.

Visualizing Trading Signals

Turning raw data into actionable insights is key in algorithmic trading. Our Trump tweet trading algorithm generates a complex stream of buy, sell, and hold signals. To make sense of this, we need effective visualization. Without clear visuals, even the most sophisticated algorithm becomes useless.

Visualizing the algorithm’s output allows traders to quickly grasp market sentiment shifts and potential trading opportunities linked to Trump’s tweets. This helps in identifying patterns, confirming the algorithm’s effectiveness, and ultimately, making informed trading decisions. Effective visualization transforms complex data into a digestible format, reducing the risk of misinterpretations and enhancing trading efficiency.

Table Representation of Trading Signals

A simple yet effective way to visualize the algorithm’s output is through a table. This table can display crucial information such as the timestamp of the tweet, the tweet’s sentiment (positive, negative, or neutral), the algorithm’s generated trading signal (buy, sell, or hold), and the predicted price movement. This structured format allows for easy comparison across different tweets and the identification of trends.

| Timestamp | Tweet Sentiment | Trading Signal | Predicted Price Movement |

|---|---|---|---|

| 2024-10-27 10:00:00 | Positive | Buy | +2% |

| 2024-10-27 12:30:00 | Negative | Sell | -1.5% |

| 2024-10-27 15:45:00 | Neutral | Hold | 0% |

This table allows traders to easily track the algorithm’s recommendations and their corresponding market predictions. The clear structure makes it straightforward to identify periods of high volatility or consistent signals, aiding in decision-making.

Candlestick Charts with Signal Overlay

Candlestick charts provide a visual representation of price movements over time. Overlaying the algorithm’s trading signals directly onto the candlestick chart provides a powerful combined visualization. For instance, a green upward-pointing arrow could indicate a “buy” signal, while a red downward-pointing arrow would represent a “sell” signal. This allows traders to visually assess the algorithm’s recommendations in the context of the actual price action. Imagine a candlestick chart showing a sharp price drop, and a red “sell” arrow appearing just before the drop. This would visually confirm the algorithm’s predictive accuracy in that instance.

Comparison of Visualization Methods

While tables offer structured data, candlestick charts with signal overlays provide a more dynamic view of the market’s reaction to the tweets and the algorithm’s recommendations. A table might be better for detailed analysis and historical data review, whereas the candlestick chart offers a more immediate and intuitive understanding of the algorithm’s performance in real-time. The choice depends on the trader’s specific needs and preferences. For example, a trader focused on short-term trades might prefer the candlestick chart, while a trader conducting more in-depth analysis might find the table more useful.

Harnessing the power of social media for algorithmic trading is a double-edged sword. While the potential for profit using an algorithm to trade on Trump tweets is undeniable, the ethical and legal complexities demand careful consideration. This exploration has shown us that building such an algorithm requires a sophisticated understanding of natural language processing, technical analysis, and risk management. It’s not just about finding patterns in tweets; it’s about understanding the nuances of market behavior and making responsible, informed decisions. The future of algorithmic trading may very well depend on the ability to responsibly integrate unconventional data sources, and Trump’s tweets might just be the start.

Insurfin Berita Teknologi Terbaru

Insurfin Berita Teknologi Terbaru