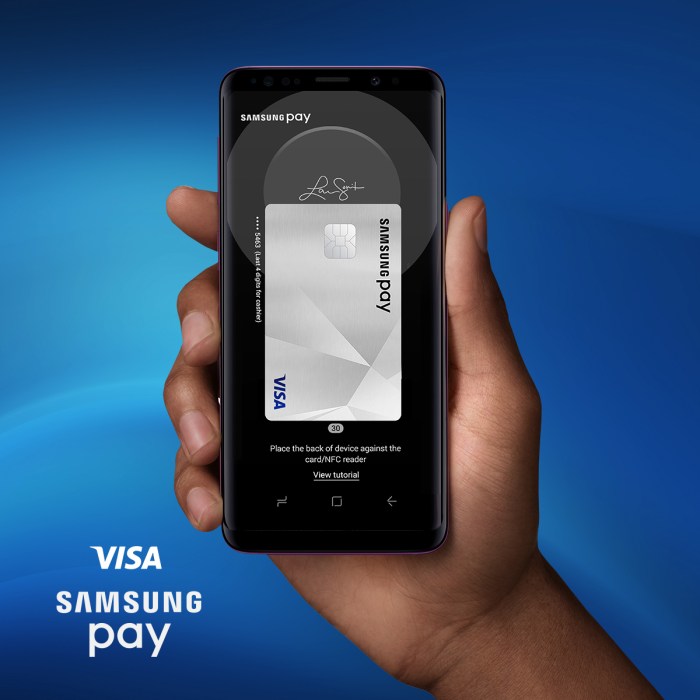

Samsung 2017 phones Samsung Pay: Remember those sleek handsets? This deep dive explores the functionality, security, user experience, and market impact of Samsung’s mobile payment system on its 2017 lineup. We’ll uncover the highs and lows, comparing it to competitors and examining user feedback from the era. Get ready for a nostalgic tech trip!

From the Galaxy S8’s elegant design to the Note 8’s powerful specs, 2017 saw some killer Samsung phones. But how did their integrated Samsung Pay perform? We’ll dissect the features, security protocols, and user experiences, highlighting both successes and shortcomings. We’ll also compare its market position to rivals like Apple Pay and Google Pay, exploring the factors behind its adoption rate and overall impact.

User Experience with Samsung Pay (2017)

Samsung Pay launched on 2017 Samsung phones with much fanfare, promising a seamless and secure mobile payment experience. However, the reality, as with any new technology, was a mixed bag of positive and negative experiences, shaped by user expectations and the technological limitations of the time. This section delves into user reviews and testimonials from that period, categorizing the feedback to offer a comprehensive understanding of the 2017 Samsung Pay user experience.

Positive User Experiences with Samsung Pay (2017)

Many users reported overwhelmingly positive experiences with Samsung Pay in 2017. The speed and ease of transactions were frequently praised. Users appreciated the contactless nature of the system, particularly its convenience in busy stores or situations where fumbling with physical cards was impractical. The integration with Samsung devices was also lauded, with many finding the smooth transition between unlocking their phone and completing a payment a significant improvement over other mobile payment systems. For example, one common review highlighted the speed of transactions compared to Apple Pay, particularly in situations with less-than-ideal NFC reader signal strength. Another recurring theme was the overall security of the system, giving users peace of mind when making purchases.

Negative User Experiences with Samsung Pay (2017)

Despite the positive feedback, several challenges plagued Samsung Pay in 2017. One recurring issue was compatibility. Not all payment terminals supported NFC technology, leading to frustrating instances where Samsung Pay failed to work. This was particularly prevalent in smaller, independent businesses. Another significant complaint centered around the limited acceptance of Samsung Pay compared to other payment systems like Apple Pay or Google Pay. This resulted in situations where users found themselves unable to use Samsung Pay, forcing them to rely on alternative methods. Some users also reported difficulties with adding cards to the Samsung Pay app, experiencing errors or delays in the process. Finally, there were occasional reports of transaction failures or glitches within the app itself, resulting in lost time and frustration.

Neutral User Experiences with Samsung Pay (2017)

A segment of users reported a more neutral experience, neither overtly positive nor negative. These users generally found Samsung Pay functional and convenient but lacked the enthusiastic praise seen in other reviews. Many in this category felt Samsung Pay was “good enough” but didn’t offer any significant advantages over other mobile payment systems they were already using. The lack of compelling reasons to switch to Samsung Pay from established platforms contributed to this neutral sentiment. In essence, for this group, Samsung Pay was a viable option but not a revolutionary one.

Suggestions for Improving the User Experience of Samsung Pay (2017)

Based on user feedback from 2017, several improvements could have enhanced the Samsung Pay experience.

- Expand merchant acceptance: Increase the number of participating merchants to minimize instances where Samsung Pay is unusable.

- Improve app stability: Address reported glitches and transaction failures to ensure a more reliable service.

- Simplify card adding process: Streamline the process of adding cards to the app, reducing errors and delays.

- Enhance error messaging: Provide more informative and user-friendly error messages to assist users when transactions fail.

- Increase NFC reader compatibility: Develop solutions to overcome challenges with less-than-optimal NFC reader signals.

Market Position of Samsung Pay in 2017: Samsung 2017 Phones Samsung Pay

In 2017, Samsung Pay was vying for a significant slice of the burgeoning mobile payment market, facing established players like Apple Pay and Google Pay. Its success hinged on a complex interplay of factors, including technological capabilities, marketing strategies, and the overall adoption of contactless payment technologies. Analyzing its market position requires examining its market share, the reasons behind its performance, and comparing its approach to that of its competitors.

Samsung Pay’s market share in 2017, while respectable, lagged behind Apple Pay and Google Pay in most major markets. Precise figures are difficult to pinpoint due to the lack of publicly available, comprehensive data from all major players. However, reports indicated that Apple Pay held a dominant position, followed by Google Pay, with Samsung Pay securing a smaller, but still substantial, portion of the market. This disparity stemmed from several factors, including the varying levels of NFC reader adoption across different regions and the limitations of Samsung Pay’s compatibility with certain banking institutions and merchants.

Samsung Pay’s Competitive Advantages and Disadvantages in 2017

Samsung Pay’s technological advantage lay in its MST (Magnetic Secure Transmission) technology, which allowed transactions on older, non-NFC enabled POS terminals. This broader acceptance was a significant differentiator, particularly in regions with slower NFC adoption. However, this advantage was offset by a less extensive merchant network compared to Apple Pay and Google Pay in some areas. Furthermore, Samsung’s marketing efforts, while significant, didn’t always translate into the same level of widespread consumer awareness as its competitors. The fragmented nature of the mobile payment landscape, with varying adoption rates across different countries and regions, also played a role in limiting Samsung Pay’s overall reach.

Comparison of Samsung Pay’s 2017 Marketing Strategies with Current Strategies, Samsung 2017 phones samsung pay

In 2017, Samsung’s marketing strategy for Samsung Pay largely focused on highlighting its MST technology and its wider acceptance compared to other mobile payment platforms. They emphasized the convenience and security features of the service, often through partnerships with banks and retailers to offer incentives and promotions. Current marketing strategies, however, have evolved to incorporate a greater focus on integration with other Samsung services and ecosystem products, creating a more seamless and integrated user experience. The emphasis has shifted from simply highlighting the transactional capabilities to showcasing the broader benefits of being part of the Samsung ecosystem. There’s also a stronger focus on data-driven personalization and targeted advertising.

Timeline of Significant Events for Samsung Pay in 2017

Several key events shaped Samsung Pay’s trajectory in 2017. While precise dates for all events are not consistently documented across various sources, a general timeline can be constructed based on available information. For example, the expansion of Samsung Pay to new markets and partnerships with new financial institutions likely occurred throughout the year, contributing to its gradual market penetration. Any major updates or improvements to the app or its security features would also have been significant milestones. Specific marketing campaigns launched during the year also mark key points in its development and market penetration strategy. Unfortunately, without access to Samsung’s internal data, a more detailed and precise timeline is difficult to create.

Samsung Pay on 2017 Samsung phones represented a significant step in mobile payment technology, offering a convenient and (mostly) secure way to pay. While it faced competition and some user experience challenges, its integration into popular devices propelled its adoption. Looking back, it’s fascinating to see how far mobile payments have come, and how the 2017 landscape laid the groundwork for today’s seamless digital transactions.

Insurfin Berita Teknologi Terbaru

Insurfin Berita Teknologi Terbaru