Verizon thinking about giving up on Yahoo? The news sent shockwaves through the tech world, sparking intense speculation about the future of both giants. For years, the pairing seemed…well, kinda awkward. Verizon’s massive investment in Yahoo, post-scandal, hasn’t exactly yielded the blockbuster results everyone hoped for. Now, whispers of a potential breakup are louder than ever, leaving us wondering: what’s next for Yahoo, and what does this mean for Verizon’s ambitious digital strategy?

This situation is a complex web of financial performance, strategic shifts, and potential impacts on employees and users alike. We’ll dive deep into the potential reasons behind Verizon’s contemplation, exploring the financial implications, the effects on Yahoo’s workforce, and alternative paths Verizon could take. From analyzing potential buyers to forecasting the future of Yahoo’s services, we’ll unpack this unfolding drama and explore the possible scenarios that lie ahead.

Verizon’s Current Relationship with Yahoo

Verizon’s relationship with Yahoo is a complex one, marked by a significant acquisition followed by a period of integration and, more recently, a gradual distancing. The initial enthusiasm surrounding the deal has given way to a more pragmatic assessment of Yahoo’s role within Verizon’s broader portfolio, leading to speculation about its future.

The current business relationship is largely characterized by Yahoo operating as a subsidiary under the Verizon umbrella. While Yahoo maintains its brand and some operational independence, its strategic direction is heavily influenced by Verizon’s overall business objectives. This includes decisions regarding investment, product development, and overall market positioning.

Verizon’s Past Investments and Strategies Related to Yahoo

Verizon’s acquisition of Yahoo in 2017, for a reported $4.5 billion, represented a significant investment in the struggling internet giant. The strategy behind the acquisition centered around bolstering Verizon’s digital media and advertising capabilities. Verizon aimed to leverage Yahoo’s established user base and brand recognition to compete more effectively in the increasingly competitive digital landscape. This involved integrating Yahoo’s assets, including its search engine, email services, and news properties, into Verizon’s existing portfolio. The expectation was a synergistic effect, combining Yahoo’s reach with Verizon’s infrastructure and technological prowess. However, the reality proved to be more challenging than anticipated.

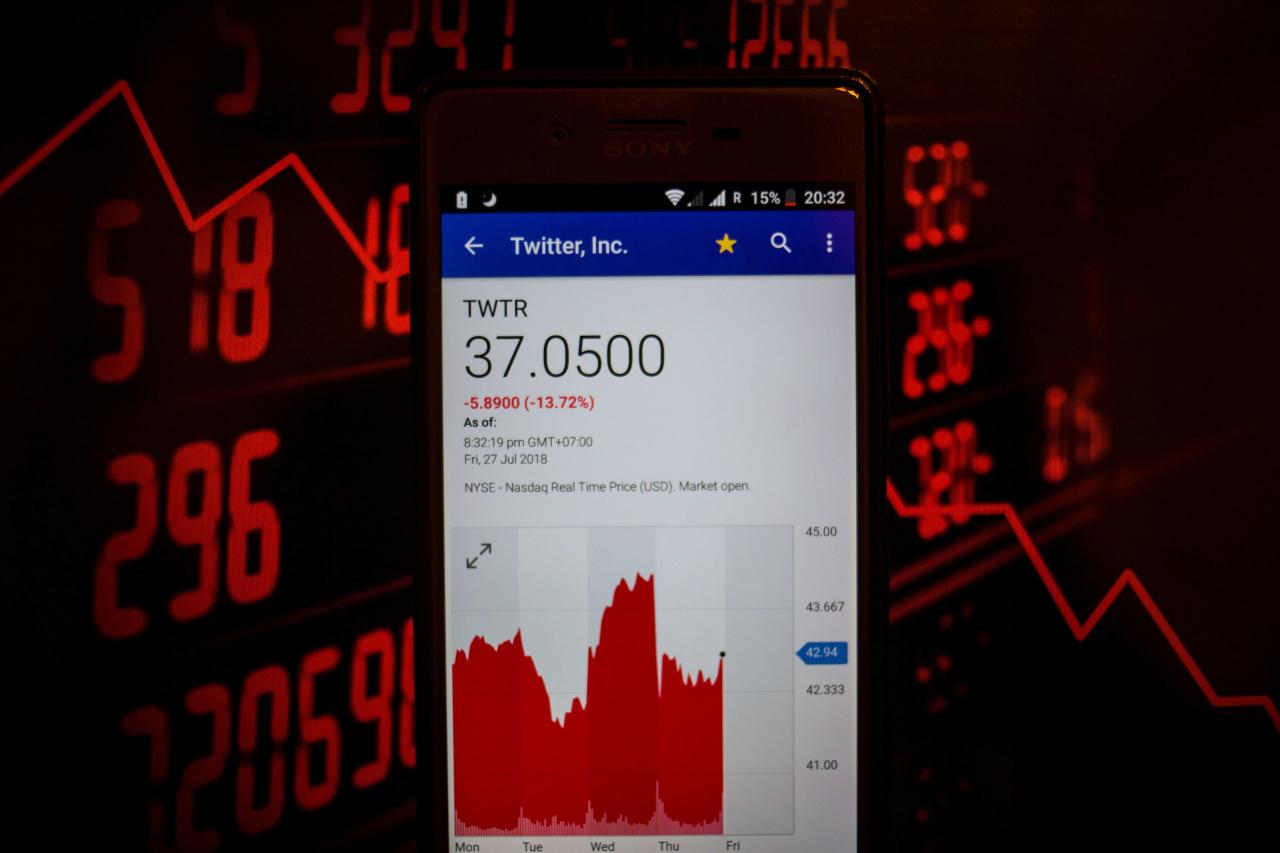

Yahoo’s Financial Performance Under Verizon’s Ownership

Yahoo’s financial performance under Verizon’s ownership has been mixed. While some aspects of the business have shown improvement, overall profitability has remained a challenge. The competitive landscape, dominated by tech giants like Google and Facebook, has put considerable pressure on Yahoo’s advertising revenue streams. Furthermore, the integration process itself proved to be costly and time-consuming, impacting overall financial results. Specific financial data would require referencing Verizon’s quarterly and annual reports, which detail the performance of their media segment, where Yahoo is included. Analyzing this data would reveal a more precise picture of Yahoo’s financial health under Verizon’s management.

Yahoo’s Market Position Compared to Competitors

Yahoo’s market position compared to its competitors, such as Google, Facebook, and Microsoft, is significantly weaker. While Yahoo retains a recognizable brand, its market share in key areas like search and online advertising is dwarfed by its larger rivals. These competitors possess superior technological capabilities, broader user bases, and more sophisticated advertising platforms. This disparity in market position has contributed to the challenges Yahoo faces in generating substantial revenue and achieving sustainable profitability. The lack of significant innovation and the struggle to adapt to evolving user preferences have also played a role in Yahoo’s diminished market standing. The company’s current focus on content and media might indicate a strategic shift towards niche markets where it might find more competitive success.

Impact on Yahoo’s Employees and Users

A Verizon divestment of Yahoo would send ripples throughout the company, impacting both its employees and its vast user base. The uncertainty surrounding a sale creates a complex scenario with potential benefits and significant drawbacks for all stakeholders. The scale of the impact hinges heavily on the eventual buyer and their strategic vision for Yahoo’s future.

The potential consequences for Yahoo’s workforce are multifaceted. A change in ownership could lead to restructuring, resulting in layoffs or reassignments. Employees might face uncertainty about their job security, benefits, and career progression. Depending on the acquiring company’s culture and priorities, there could be a shift in company values and work environment. This could range from minor adjustments to a complete overhaul of operational processes and company culture. For example, a tech giant focused on rapid innovation might prioritize speed over stability, leading to a different work dynamic compared to Yahoo’s existing structure.

Potential Employee Impacts

A sale could lead to various outcomes for Yahoo’s employees. Some might find new opportunities within the acquiring company, while others might be let go as part of a restructuring process. This could trigger a wave of talent acquisition by competing companies, especially if Yahoo’s skilled workforce is suddenly available on the job market. The experience of employees during this transition will depend largely on the acquiring company’s approach to integration and employee relations. The process could be smooth and supportive, or it could be disruptive and stressful, causing anxiety and uncertainty.

Consequences for Yahoo Users

The impact on Yahoo users is also a key consideration. A change in ownership could result in alterations to Yahoo’s services, product offerings, and user experience. For instance, a new owner might prioritize certain services over others, leading to the discontinuation or reduction of features some users rely on. Privacy policies could also change, potentially affecting how user data is collected, used, and protected. Yahoo Mail, for example, is a widely used service; any significant changes to its functionality or security could impact millions of users. A shift towards a more data-driven approach by the new owner might also lead to increased targeted advertising, which some users may find intrusive.

Potential Service and Product Changes, Verizon thinking about giving up on yahoo

Yahoo’s services and products could undergo significant transformations following a change in ownership. This could include modifications to the user interface, the addition or removal of features, and changes to pricing models. Integration with other services from the acquiring company is also a possibility. For instance, if a social media company acquires Yahoo, we might see increased integration between Yahoo services and the social media platform. Conversely, a company focusing on search engines might prioritize improvements to Yahoo Search, potentially neglecting other aspects of the platform. The level of change depends heavily on the strategic objectives of the new owner.

Stakeholder Concerns

Several concerns are likely to be raised by Yahoo’s stakeholders regarding a potential sale. These include:

- Job security and employee benefits for Yahoo’s workforce.

- The potential impact on user privacy and data security.

- Changes to the quality and availability of Yahoo’s services and products.

- The long-term financial stability and success of the company under new ownership.

- Maintenance of Yahoo’s brand reputation and user trust.

These concerns highlight the need for transparency and clear communication from both Verizon and any potential buyer throughout the divestment process. Addressing these issues proactively can help mitigate potential negative consequences for all stakeholders.

Illustrative Scenarios: Verizon Thinking About Giving Up On Yahoo

Verizon’s potential moves regarding Yahoo are rife with possibilities, each with its own set of winners and losers. Let’s explore three distinct scenarios, painting a picture of what could unfold. These scenarios are, of course, speculative, but grounded in the realities of the tech market and Verizon’s business strategy.

Verizon Successfully Divests from Yahoo

A successful divestment would likely involve a strategic sale to a private equity firm or another tech company with a complementary portfolio. The process would start with Verizon engaging investment banks to run an auction process, attracting bids from potential buyers. Due diligence would be extensive, focusing on Yahoo’s assets (including its significant user base and intellectual property), liabilities (including potential legal challenges), and overall financial health. The sale price would depend heavily on the level of interest and the overall market conditions. A successful outcome would see Verizon freeing up capital for other investments while Yahoo would gain a new owner potentially equipped to revitalize its platforms. This could lead to renewed investment in product development, potentially focusing on specific niches where Yahoo could regain market share, or a complete overhaul of its strategy. The outcome for Yahoo’s employees would be uncertain, potentially involving layoffs, reassignments, or integration into the new owner’s structure.

Verizon Retains Ownership of Yahoo with Significant Operational Changes

Instead of selling, Verizon might choose to significantly restructure Yahoo’s operations. This could involve a major cost-cutting exercise, focusing on profitability rather than market share expansion. They might consolidate services, shut down less profitable ventures, and streamline the organization. This scenario might involve layoffs and a shift in strategic focus, possibly concentrating on areas like advertising technology or specific niche communities. Verizon might also invest in upgrading Yahoo’s infrastructure and technology, making it more efficient and competitive. The success of this approach would depend on Verizon’s ability to effectively execute the restructuring and identify profitable areas of focus within Yahoo’s diverse portfolio. The resulting Yahoo would be a leaner, more focused entity, possibly less ambitious in terms of market share but potentially more financially stable.

Third-Party Acquisition of Yahoo by a Private Equity Firm

Imagine a scenario where a large private equity firm, such as Apollo Global Management or KKR, acquires Yahoo. These firms often specialize in acquiring undervalued assets and restructuring them for profitability. Their strategy would likely involve a combination of cost-cutting measures, focusing on streamlining operations and improving efficiency. They might also invest in specific areas of Yahoo’s business, such as its advertising technology or its email service, to increase profitability. The impact on Yahoo’s products and services would depend on the private equity firm’s strategy. Some services might be discontinued, while others might be enhanced or integrated with other services within their portfolio. Employee restructuring would be likely, with some roles being eliminated and others potentially being reshaped to fit the new organizational structure. The firm might also leverage Yahoo’s extensive user base to increase advertising revenue or explore strategic partnerships to expand its reach. This scenario would represent a significant shift in ownership and direction for Yahoo, potentially leading to a more financially stable but potentially less innovative company.

The Verizon-Yahoo saga is far from over. Whether Verizon chooses to divest, restructure, or double down, the decision will have far-reaching consequences. The future of Yahoo hangs in the balance, and the tech landscape will undoubtedly be reshaped by the outcome. This isn’t just about dollars and cents; it’s a story about legacy, ambition, and the ever-evolving dynamics of the digital age. Stay tuned for the next chapter.

So Verizon’s reportedly pondering ditching Yahoo – a move that feels almost as outdated as a flip phone. Meanwhile, in the tech world, things are moving at a faster pace, as evidenced by the release of the Samsung Galaxy J1, a surprisingly affordable quad-core phone, check it out samsung galaxy j1 gets official with quad core cpu.

The contrast highlights just how quickly the digital landscape shifts; Verizon’s hesitation might be a sign they’re struggling to keep up.

Insurfin Berita Teknologi Terbaru

Insurfin Berita Teknologi Terbaru