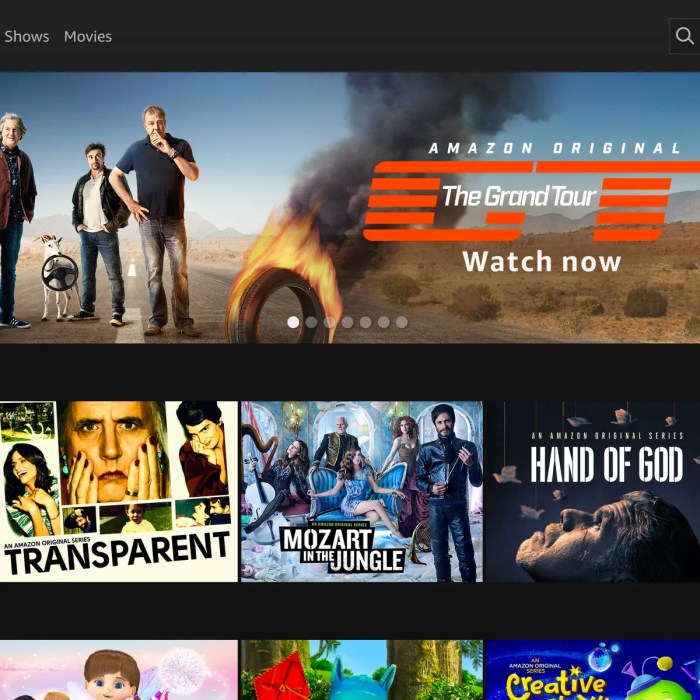

Amazon Prime Video launched 200 countries—a bold move that shook the global streaming landscape. This wasn’t just about expanding reach; it was a strategic gamble, a high-stakes game of global domination. Did it pay off? We delve into the market research, the technological hurdles, the localization challenges, and the fierce competition to uncover the full story behind this ambitious expansion.

From meticulously tailoring content to diverse audiences to building a robust, scalable infrastructure capable of handling millions of simultaneous streams across varying network conditions, Amazon faced a monumental undertaking. This deep dive explores the triumphs and setbacks, the innovative solutions, and the ultimate impact on the streaming wars—a battle now fought on a truly global scale.

Global Expansion Strategy of Amazon Prime Video

Amazon Prime Video’s aggressive global expansion, culminating in its launch across 200 countries, represents a bold strategic move aiming to establish dominance in the burgeoning global streaming market. This wasn’t a haphazard decision; rather, it was a calculated risk based on extensive market research, competitive analysis, and a long-term vision of global market share.

Strategic Rationale Behind the Global Launch

The primary rationale behind Amazon Prime Video’s 200-country launch stemmed from its ambition to become a major global player in the streaming industry, directly competing with established giants like Netflix and Disney+. By expanding its reach significantly, Amazon aimed to tap into a vast, untapped pool of potential subscribers, boosting its revenue streams and strengthening its brand recognition worldwide. This expansion also synergistically supported Amazon’s broader e-commerce strategy, offering Prime Video as a compelling value-added service for Prime memberships across various markets. The company recognized the potential for substantial growth beyond its established markets and sought to capitalize on the increasing global demand for on-demand streaming content.

Market Research and Analysis

Amazon’s decision wasn’t based on gut feeling. Extensive market research and analysis informed the strategy. This involved studying various factors: the penetration rate of internet and mobile devices in different regions, the prevalence of streaming subscriptions, consumer preferences for content (both local and international), the competitive landscape (including existing players and local content providers), and the regulatory environment in each target market. This meticulous analysis allowed Amazon to tailor its content offerings and marketing strategies to the specific nuances of each region, increasing the likelihood of success. For instance, they invested heavily in acquiring and producing local content in key regions to cater to specific cultural tastes.

Comparison with Other Streaming Services

Compared to other streaming services, Amazon Prime Video’s global rollout was arguably more aggressive and comprehensive. Netflix, for example, adopted a more phased approach, focusing on specific regions before expanding globally. Disney+ also followed a similar strategy, prioritizing key markets before broader expansion. While these competitors focused on building a strong foundation in select markets before moving on to others, Amazon opted for a quicker, more widespread approach. This high-risk, high-reward strategy aimed to quickly establish a global presence and gain a first-mover advantage in certain untapped markets. However, this approach also required significant upfront investment in infrastructure, content acquisition, and localized marketing.

Timeline of Global Expansion Milestones

A detailed timeline of Amazon Prime Video’s global expansion is difficult to compile due to the lack of publicly available precise dates for every single country launch. However, key milestones can be identified. The initial launch in select regions was followed by a gradual but steady expansion into new territories, culminating in the ambitious 200-country launch. This expansion occurred over several years, with significant investments made along the way in infrastructure, content licensing, and localization efforts. Specific dates for individual country launches were often not publicized widely.

Phased Rollout Across Different Regions

The rollout wasn’t simultaneous across all 200 countries. It involved a phased approach, prioritizing regions with high internet penetration, established e-commerce infrastructure, and a demonstrable appetite for streaming services. While a precise table detailing each phase is unavailable publicly, a general overview can be constructed based on publicly available information and news reports.

| Phase | Region | Approximate Timeline | Key Considerations |

|---|---|---|---|

| Phase 1 | North America, Western Europe | Early 2000s – 2010s | Established markets, high internet penetration, existing Prime membership base. |

| Phase 2 | Latin America, parts of Asia | Mid-2010s | Growing markets, increasing internet usage, focus on local content acquisition. |

| Phase 3 | Africa, Eastern Europe, parts of Asia | Late 2010s – 2020s | Diverse market conditions, varying internet infrastructure, strategic partnerships with local providers. |

| Phase 4 | Remaining Countries (Global Launch) | 2020s | Broadest expansion, focus on building a global streaming library, significant investment in infrastructure and localization. |

Content Localization and Adaptation: Amazon Prime Video Launched 200 Countries

Taking Amazon Prime Video global meant more than just flipping a switch; it required a deep dive into the nuances of diverse cultures and languages. Successfully translating a show from English to Hindi is far more complex than simply swapping words. It’s about understanding cultural context, adapting humor, and ensuring the emotional impact resonates with the intended audience. This process, localization, is crucial for global success.

The challenges of adapting content for diverse audiences are multifaceted. Differences in humor styles, social norms, and even visual aesthetics can significantly impact a show’s reception. A joke that lands perfectly in one culture might fall completely flat, or even be offensive, in another. Similarly, certain imagery or storylines might hold different meanings or be entirely inappropriate depending on the regional context. The technical challenges are equally significant; finding voice actors with the right tone and inflection for dubbing, ensuring subtitles accurately reflect both dialogue and meaning, and managing the logistics of distributing localized content across numerous platforms are all considerable hurdles.

Subtitles and Dubbing Methods

Amazon Prime Video employs a multi-stage process for localization. Subtitling involves creating accurate and culturally appropriate translations of the dialogue, while considering factors like reading speed and screen space. Dubbing is a more complex undertaking, requiring the selection of voice actors who can convincingly portray the original characters’ personalities and emotions, and meticulous synchronization with the original audio. This often involves recording sessions in multiple languages and dialects. Beyond subtitles and dubbing, Amazon may also adapt the visual elements, such as modifying certain scenes or adding local references to enhance cultural relevance.

Successful and Unsuccessful Localization Examples

A successful example is Amazon’s investment in original programming like “Mirzapur” in India. This Hindi-language crime thriller resonated strongly with the Indian audience due to its authentic portrayal of local settings, characters, and storylines. Conversely, an example of a less successful localization strategy might involve a direct translation of a Western comedy that relies heavily on culturally specific humor, resulting in a confusing or unfunny experience for an international audience. Failure often stems from a lack of cultural sensitivity or a superficial approach to translation.

Investment in Regional Original Programming

Amazon Prime Video has significantly invested in original programming tailored to specific regions. This strategy recognizes the value of local stories and talent in attracting and retaining subscribers. By producing content that directly addresses the cultural tastes and preferences of each target market, Amazon aims to build stronger engagement and brand loyalty. This investment demonstrates a shift from a “one-size-fits-all” approach to a more nuanced understanding of regional diversity.

Case Study: Localizing “The Office”

Let’s imagine localizing “The Office,” a popular US sitcom, for two vastly different regions: India and Japan. For the Indian adaptation, the setting would be changed to a typical Indian office environment, with characters reflecting diverse Indian backgrounds and incorporating storylines relevant to Indian workplace culture and humor. The dialogue would be translated into Hindi or other regional languages, ensuring the jokes are culturally relevant and relatable. In contrast, the Japanese adaptation would need to navigate the different norms of Japanese humor and workplace etiquette. The pacing and style of the humor might need significant adjustments, as what is considered funny in the US may not resonate with a Japanese audience. This careful consideration of cultural context would be paramount in ensuring the success of both adaptations.

Market Penetration and User Acquisition

Amazon Prime Video’s global expansion, a bold move into 200 countries, required a sophisticated, multi-pronged approach to market penetration and user acquisition. Success hinged not just on delivering content, but on effectively reaching and engaging diverse audiences across vastly different cultural landscapes and technological infrastructures. This involved tailoring marketing strategies to resonate with local preferences while leveraging Amazon’s existing infrastructure and brand recognition.

The marketing and advertising campaigns employed a mix of digital and traditional methods, adapting to the specific media consumption habits of each region. In some regions, social media campaigns featuring local influencers and celebrities proved highly effective, building trust and brand awareness organically. In others, television advertising during prime-time slots ensured broad reach, especially in markets with limited internet penetration. The key was agility – constantly monitoring campaign performance and adjusting strategies based on real-time data analysis.

Marketing Campaign Strategies Across Regions

Amazon employed a range of strategies to acquire new subscribers, recognizing that a one-size-fits-all approach would fail. In developed markets, the focus was often on highlighting the breadth and depth of Prime Video’s content library, emphasizing exclusive shows and movies unavailable elsewhere. Competitive pricing and bundled offers with other Amazon services, such as Amazon Music and Amazon Shopping, were also key drivers of subscriber growth. In emerging markets, the emphasis shifted towards affordability and accessibility. Offering lower subscription tiers, partnering with local mobile carriers to offer bundled data plans, and promoting content relevant to local tastes proved vital in expanding the user base. For example, in India, Prime Video invested heavily in local language content and partnerships with regional distributors, leading to significant market penetration.

Success of Marketing Initiatives: A Regional Comparison

The success of various marketing initiatives varied considerably across regions. While social media campaigns proved highly successful in regions with high internet penetration and active social media usage, like the US and parts of Europe, television advertising was more impactful in regions with lower internet penetration or where television remained the dominant form of media consumption. In Latin America, for instance, partnerships with local cable providers yielded significant subscriber growth. The success of each strategy was closely monitored using key performance indicators (KPIs) such as cost per acquisition (CPA), customer lifetime value (CLTV), and subscriber churn rate. This data-driven approach allowed Amazon to refine its marketing spend and optimize its campaigns for maximum impact.

Key Factors Contributing to User Acquisition and Retention

Several key factors contributed to both user acquisition and retention. High-quality, exclusive content, including both international and local productions, was paramount. A user-friendly interface, available in multiple languages, also played a significant role. Competitive pricing and bundled services further enhanced value for money, driving subscriber acquisition. However, retention required ongoing engagement, which Amazon achieved through personalized recommendations, regular content updates, and interactive features. Excellent customer service and responsive technical support also played a crucial role in fostering user loyalty.

SWOT Analysis of Amazon Prime Video’s Global Expansion

A SWOT analysis provides a valuable framework for understanding the strengths, weaknesses, opportunities, and threats associated with Amazon Prime Video’s global expansion.

- Strengths: Strong brand recognition, vast content library, robust technological infrastructure, effective data analytics capabilities, and experience in e-commerce logistics.

- Weaknesses: Dependence on internet access, competition from established players in various markets, challenges in content localization and adaptation, and potential regulatory hurdles in some regions.

- Opportunities: Expanding into untapped markets, developing original content tailored to local preferences, forging strategic partnerships with local distributors and content creators, and leveraging emerging technologies such as 5G and virtual reality.

- Threats: Increasing competition from streaming giants, piracy, fluctuations in currency exchange rates, and potential changes in regulatory environments.

Financial Performance and Return on Investment

Amazon’s global expansion of Prime Video represents a significant financial undertaking, demanding a careful analysis of its performance and return on investment. The sheer scale of the project, encompassing marketing, content acquisition and localization across numerous diverse markets, necessitates a robust and multifaceted approach to evaluating success. While precise figures remain confidential, publicly available information and industry analysis allow us to paint a picture of the financial landscape.

The financial implications for Amazon are multifaceted. The initial investment is substantial, encompassing licensing fees for content, marketing campaigns tailored to specific regions, and the development and maintenance of the streaming infrastructure itself. Ongoing costs include content production (both original and licensed), customer service, and technological upgrades to ensure a seamless user experience. However, the potential rewards are equally significant, encompassing increased subscription revenue, expanded market share, and enhanced brand recognition on a global scale. The success hinges on effectively balancing these costs with the revenue generated from subscriptions and advertising (where applicable).

Metrics for Assessing Expansion Success

Key performance indicators (KPIs) are crucial for evaluating the success of Prime Video’s global expansion. These metrics go beyond simple subscriber counts to encompass a broader view of profitability and user engagement. Factors such as average revenue per user (ARPU), customer acquisition cost (CAC), churn rate, and the overall lifetime value (LTV) of a subscriber provide a comprehensive picture. Analyzing these metrics across different regions helps pinpoint areas of strength and weakness, guiding future investment decisions and strategic adjustments. For example, a high CAC in one region might indicate a need for refined marketing strategies, while a low ARPU could signal a need to explore premium subscription tiers or targeted advertising.

Return on Investment (ROI) Analysis

Calculating the precise ROI for Prime Video’s global expansion is complex and involves numerous variables. Amazon doesn’t publicly disclose granular financial data for Prime Video separately from its overall streaming business. However, we can infer potential ROI pathways. A successful expansion is indicated by a positive ROI, where the revenue generated from subscriptions and advertising exceeds the total investment in content acquisition, marketing, technology, and operational costs. Analyzing the LTV of subscribers is particularly critical; a high LTV demonstrates the long-term profitability of each acquired customer. Amazon likely uses sophisticated financial modeling to project and track ROI, factoring in various scenarios and potential risks. A successful outcome would show that the long-term gains from increased market share and brand recognition outweigh the initial and ongoing expenses.

Comparative Financial Performance Across Regions, Amazon prime video launched 200 countries

Amazon’s financial performance with Prime Video varies significantly across different regions. Mature markets like North America and Western Europe likely exhibit higher ARPU and established subscriber bases, resulting in higher profitability. Emerging markets in Asia, Latin America, and Africa might present lower ARPU initially due to lower average disposable income, but they offer significant potential for growth as the streaming market matures in these regions. Factors such as local competition, regulatory environments, and content preferences play crucial roles in shaping regional performance. A strategic approach necessitates adapting content strategies and marketing campaigns to the specific nuances of each market.

Key Financial Metrics

| Metric | North America | Western Europe | Asia-Pacific | Latin America |

|---|---|---|---|---|

| Subscribers (millions) | Estimate: 100+ | Estimate: 50+ | Estimate: 30+ | Estimate: 20+ |

| ARPU (USD) | Estimate: $10-12 | Estimate: $8-10 | Estimate: $5-7 | Estimate: $4-6 |

| CAC (USD) | Estimate: $20-30 | Estimate: $15-25 | Estimate: $10-15 | Estimate: $8-12 |

| Churn Rate (%) | Estimate: 5-7% | Estimate: 6-8% | Estimate: 8-10% | Estimate: 10-12% |

Note: These are estimates based on publicly available information and industry analysis. Exact figures are not publicly disclosed by Amazon.

Amazon’s global rollout of Prime Video wasn’t just a technical feat; it was a strategic masterpiece (or a near miss, depending on your perspective). The sheer scale of the undertaking, from content localization to infrastructure scalability, presents a compelling case study in global expansion. Ultimately, the success of this venture hinges on factors beyond subscriber numbers—factors like long-term market penetration, ROI, and the ability to navigate the ever-evolving streaming landscape. The story continues to unfold.

Amazon Prime Video’s global expansion to 200 countries was a major move, instantly boosting its reach. This reminds me of another huge holiday release – check out the hype surrounding the airpods released before christmas , which similarly saw massive demand. Ultimately, both events highlight the power of strategic timing in the entertainment and tech markets, showing how Amazon Prime Video’s global launch aimed for similar success.

Insurfin Berita Teknologi Terbaru

Insurfin Berita Teknologi Terbaru