Android Pay in Japan: It’s a story of slow adoption in a land of technological marvels. While Japan boasts cutting-edge tech and a high mobile penetration rate, the embrace of Android Pay hasn’t exactly been a whirlwind romance. This isn’t just about numbers; it’s about understanding the cultural nuances, existing payment systems, and the unique challenges Google faces in cracking the Japanese market. We’ll delve into the why, the how, and the what-ifs of Android Pay’s journey in the Land of the Rising Sun.

This exploration will cover everything from comparing Android Pay’s adoption rate against other popular contactless payment methods in Japan, to examining the specific features available to Japanese users and comparing them to international offerings. We’ll also analyze the security and privacy aspects, Android Pay’s integration with Japan’s existing infrastructure, and finally, speculate on its future prospects and potential for growth.

Android Pay Adoption in Japan: Android Pay In Japan

Japan’s embrace of cashless payments has been a gradual process, with a strong cultural preference for physical cash still prevalent. While contactless payment systems are gaining traction, Android Pay’s journey in the Japanese market has been a unique blend of challenges and opportunities. Its adoption rate lags behind other major players, revealing a complex interplay of factors influencing consumer behavior and market dynamics.

Android Pay’s adoption rate in Japan is significantly lower compared to other major contactless payment systems like QuickPay and Apple Pay. While precise figures are difficult to obtain publicly, anecdotal evidence and market reports suggest a considerably smaller user base for Android Pay compared to its competitors. This disparity highlights the hurdles Android Pay has faced in penetrating the Japanese market.

Factors Contributing to Android Pay Adoption in Japan

Several factors contribute to the relatively low adoption rate of Android Pay in Japan. The deeply ingrained preference for cash remains a significant barrier. Many Japanese consumers, particularly older generations, are comfortable and familiar with cash transactions, viewing them as secure and convenient. Furthermore, the existing infrastructure of established mobile payment systems like QuickPay, which enjoys widespread acceptance and integration with various services, presents a strong competitive advantage. The relatively high smartphone penetration rate in Japan is a positive factor, but the existing entrenched payment habits overshadow this potential advantage. Another factor is the level of marketing and promotion efforts by Google compared to other players.

Demographics of Android Pay Users in Japan

While precise demographic data on Android Pay users in Japan is unavailable publicly, it’s reasonable to assume that younger demographics, particularly those more familiar with technology and international trends, are more likely to adopt Android Pay. This aligns with global trends showing a higher adoption rate among younger age groups for digital payment systems. However, the dominance of QuickPay suggests that even within younger demographics, a significant portion prefers the locally established and well-integrated system. This highlights the importance of understanding local preferences when introducing a new technology.

Hypothetical Marketing Campaign Targeting Younger Adults (18-35)

To increase Android Pay usage among younger adults (18-35), a marketing campaign could leverage their affinity for social media and trendy experiences. The campaign, titled “Unlock Your City,” would feature visually appealing videos and social media posts showcasing how Android Pay simplifies daily life in urban Japan. These would highlight scenarios like effortlessly paying for coffee, transportation, and shopping at trendy boutiques, emphasizing the convenience and speed. Influencer marketing could be employed, featuring popular Japanese social media personalities demonstrating Android Pay’s seamless integration into their lifestyle. Partnerships with popular cafes, restaurants, and clothing stores frequented by this demographic would further promote acceptance and usage. Limited-time promotions, such as discounts or cashback offers for first-time users, could provide an added incentive. The overall message would focus on positioning Android Pay not just as a payment method, but as a key to unlocking a smoother, more stylish, and convenient urban experience. This approach aims to resonate with the target audience’s values and aspirations, overcoming the ingrained preference for cash by showcasing Android Pay’s unique advantages within their context.

Security and Privacy of Android Pay in Japan

Android Pay’s success in Japan hinges not only on its convenience but also on its robust security and privacy measures. Users in Japan, known for their tech-savviness and privacy concerns, demand a high level of assurance when entrusting their financial data to digital platforms. Let’s delve into the specifics of how Android Pay addresses these concerns.

Android Pay’s Security Measures in Japan

Android Pay employs a multi-layered security approach to safeguard user data. This includes tokenization, where actual card numbers are replaced with unique digital tokens for transactions, preventing the exposure of sensitive financial information. Biometric authentication, such as fingerprint scanning or facial recognition, adds an extra layer of protection, ensuring only authorized users can access the app and make payments. Furthermore, Google’s advanced fraud detection systems continuously monitor transactions for suspicious activity, flagging potentially fraudulent attempts for review and preventing unauthorized access. This system learns and adapts to evolving fraud patterns, offering a proactive defense against emerging threats. The platform also benefits from Google’s extensive security infrastructure, a resource that smaller payment systems often lack.

Android Pay’s Privacy Policy and Compliance with Japanese Regulations

Android Pay’s privacy policy in Japan adheres to the stringent regulations set by the Japanese government, including the Act on the Protection of Personal Information. This policy clearly Artikels how user data is collected, used, and protected. Google is transparent about the types of data collected, which typically includes transaction details (but not the full card number), device information, and location data (for relevant services like nearby store discovery). Importantly, users have control over their data, with options to review and manage their information within the app’s settings. Google regularly updates its privacy policy to reflect changes in technology and regulations, ensuring ongoing compliance with Japanese law. The company also participates in industry initiatives to improve data security and privacy practices across the digital payments landscape.

Comparison of Android Pay Security with Other Digital Payment Systems in Japan

While Android Pay offers robust security features, it’s beneficial to compare its security measures with other popular digital payment systems in Japan, such as Apple Pay and various local e-wallets. Each system employs its own security protocols, and understanding the nuances can help users make informed choices.

| Feature | Android Pay | Apple Pay | Other Relevant Systems (e.g., Rakuten Pay, PayPay) |

|---|---|---|---|

| Tokenization | Yes | Yes | Generally Yes, specifics vary |

| Biometric Authentication | Yes (fingerprint, facial recognition) | Yes (Touch ID, Face ID) | Variable, often includes PIN or password |

| Fraud Detection | Advanced machine learning-based system | Robust system, details less publicly available | Varies significantly, often relying on transaction monitoring and reporting |

| Data Encryption | Uses industry-standard encryption protocols | Uses industry-standard encryption protocols | Generally uses industry-standard encryption, specifics vary |

| Regulatory Compliance | Compliant with Japanese personal information protection laws | Compliant with Japanese personal information protection laws | Generally compliant, specifics vary depending on the provider |

Future of Android Pay in Japan

Android Pay’s journey in Japan has been a fascinating blend of challenges and opportunities. While it hasn’t achieved the widespread adoption seen in other markets, the potential for growth remains significant, particularly considering Japan’s increasingly cashless society and the growing comfort with digital transactions among its population. The next five years will be crucial in determining whether Android Pay can truly establish itself as a major player in the Japanese mobile payments landscape.

The next five years will likely witness a substantial increase in Android Pay’s user base in Japan. Factors such as the continued push towards digitalization by the Japanese government, increasing smartphone penetration, and the growing familiarity of younger generations with contactless payment methods all contribute to a positive outlook. However, this growth won’t be without its hurdles.

Potential Growth of Android Pay in Japan

Several factors point towards significant growth for Android Pay in Japan over the next five years. Firstly, the ongoing government initiatives promoting cashless transactions will create a more receptive environment for digital payment solutions. Secondly, the younger demographic in Japan is already demonstrating a preference for mobile payments, a trend that is expected to continue. Thirdly, improved marketing and partnerships with major Japanese retailers and businesses will increase Android Pay’s visibility and acceptance. We can envision a scenario where, similar to the growth of mobile payments in South Korea, Android Pay’s adoption rate accelerates significantly as the convenience and security of the platform become more widely understood. This could lead to a doubling or even tripling of its current user base within the next five years, depending on the success of Google’s strategic initiatives.

Obstacles to Android Pay’s Growth in Japan

Despite the promising outlook, Android Pay faces considerable challenges. The entrenched dominance of existing payment systems, such as Suica and Pasmo, presents a major obstacle. These systems are deeply integrated into the daily lives of Japanese citizens and enjoy widespread acceptance. Furthermore, overcoming consumer concerns about security and privacy remains crucial. Building trust with a population accustomed to highly secure and private financial systems requires a sustained effort to demonstrate Android Pay’s robust security measures. Finally, the competitive landscape, with other mobile payment providers vying for market share, necessitates a clear and differentiated value proposition to attract and retain users. The lack of aggressive marketing and partnerships in the past has also contributed to slower than expected adoption.

Potential New Features to Enhance Android Pay’s Appeal

To further enhance its appeal, Android Pay could incorporate features tailored to the Japanese market. Integration with popular loyalty programs and point systems is a prime example. Many Japanese consumers are highly engaged with these programs, and seamlessly integrating them into Android Pay would significantly improve its value proposition. Another area for improvement is the introduction of more localized payment options, such as support for specific Japanese e-commerce platforms and smaller businesses. Furthermore, enhanced security features, specifically addressing concerns related to data privacy and fraud, could boost consumer confidence. Finally, incorporating features that simplify the process of linking existing bank accounts and credit cards would streamline the onboarding process and make the app more user-friendly.

Google needs a multi-pronged approach to increase Android Pay’s market share. Aggressive marketing campaigns targeting specific demographics, particularly younger generations, are crucial. Strategic partnerships with major Japanese retailers, banks, and transportation networks are essential to expand Android Pay’s acceptance. Investing in public awareness campaigns to educate consumers about the benefits and security features of Android Pay is also vital. Furthermore, offering attractive incentives, such as cashback programs or discounts, could incentivize adoption. Finally, actively addressing user feedback and continuously improving the app’s functionality and user experience will foster loyalty and attract new users. A concerted effort across all these areas will be essential to compete effectively in the Japanese market.

Android Pay and Competition in Japan

The Japanese mobile payment landscape is a fiercely competitive arena, with a diverse range of players vying for market share. Android Pay, while a globally recognized brand, faced a unique set of challenges in penetrating this established market. Understanding its competitive positioning is crucial to analyzing its success and potential future growth.

Unlike some Western markets where a few dominant players exist, Japan boasts a complex ecosystem of established mobile payment systems, each with its own strengths and loyal user base. This makes direct comparison and analysis essential for understanding Android Pay’s place within this ecosystem.

Major Competitors and Comparative Analysis

Android Pay’s main competitors in Japan include established players like Rakuten Pay, PayPay (backed by SoftBank and Yahoo Japan), LINE Pay, and Apple Pay. Each boasts distinct features catering to specific user preferences. Rakuten Pay leverages the extensive Rakuten ecosystem, offering points and rewards to its loyal customer base. PayPay, on the other hand, aggressively pursued market share through cashback promotions and widespread merchant adoption. LINE Pay, benefiting from LINE’s massive user base as a popular messaging app, offers seamless integration within its ecosystem. Apple Pay, similarly to Android Pay, benefits from its brand recognition and integration with Apple devices, although its acceptance is arguably still lower in Japan compared to other domestic players. Android Pay, while integrating well with Android devices, needed to overcome the pre-existing loyalty and familiarity Japanese consumers had with these established platforms.

Competitive Advantages and Disadvantages of Android Pay in Japan

Android Pay’s key advantage lies in its global brand recognition and potential for seamless integration within the broader Google ecosystem. However, its late entry into the already saturated Japanese market presented significant challenges. The lack of aggressive initial marketing campaigns and the pre-existing loyalty towards domestic players hampered its early adoption. Furthermore, the comparatively limited merchant acceptance compared to some competitors hindered its widespread use. A disadvantage is the perception among some consumers that domestic players offer more lucrative reward programs and better integration with local services.

Successful Marketing Strategies of Competitors

Competitors like PayPay employed incredibly successful marketing strategies focusing on aggressive cashback campaigns and widespread merchant partnerships. Their high-profile advertising, often featuring popular celebrities, created significant brand awareness and drove user adoption. LINE Pay’s strategy centered on leveraging its existing user base within the popular messaging app, providing a convenient and familiar payment interface. These strategies highlight the importance of aggressive marketing and strong partnerships in capturing market share within Japan’s competitive payment landscape.

SWOT Analysis of Android Pay in Japan

A SWOT analysis provides a concise overview of Android Pay’s position. Its Strengths include its global brand recognition and potential for integration with other Google services. Weaknesses include late market entry, limited initial marketing efforts, and lower merchant acceptance compared to competitors. Opportunities lie in leveraging Google’s technological advancements and expanding merchant partnerships. Threats include the continued dominance of established players and the potential for new entrants to disrupt the market. Effectively addressing these factors is crucial for Android Pay’s future success in Japan.

So, is Android Pay destined to become a major player in the Japanese payments landscape? The answer, like many things in Japan, is nuanced. While challenges remain, the potential for growth is undeniable. Understanding the cultural context, adapting to the existing infrastructure, and addressing specific user concerns are key to unlocking Android Pay’s full potential in this technologically advanced yet uniquely traditional market. The future of Android Pay in Japan hinges on Google’s ability to navigate these complexities and connect with Japanese consumers on a deeper level.

So, Android Pay in Japan? Pretty smooth, right? I mean, unless you’re suddenly transported to a bizarre parallel dimension where the only thing that matters is the insane news that kuma panda added tekken 7 – talk about a game changer! Anyway, back to the real world and the convenience of tapping your phone for payments.

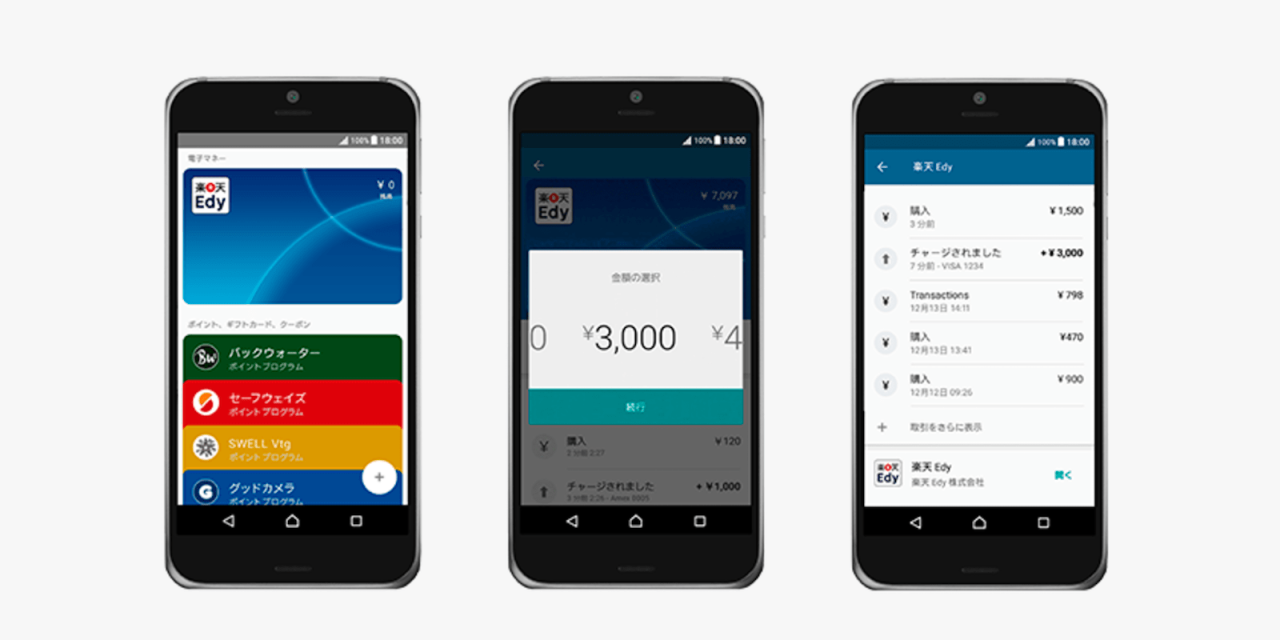

Android Pay in Japan makes everyday transactions a breeze.

Insurfin Berita Teknologi Terbaru

Insurfin Berita Teknologi Terbaru